This is the third post in the NYU Founder's Guide to VC series. Read Understanding VC Fund Structure & Economics and The Fundraising Process: From First Pitch to First Check first. Here we cover dilution and how to manage it.

As a founder, it's natural to feel protective of your ownership. But understanding dilution is essential as you raise capital.

Valuation & dilution basics

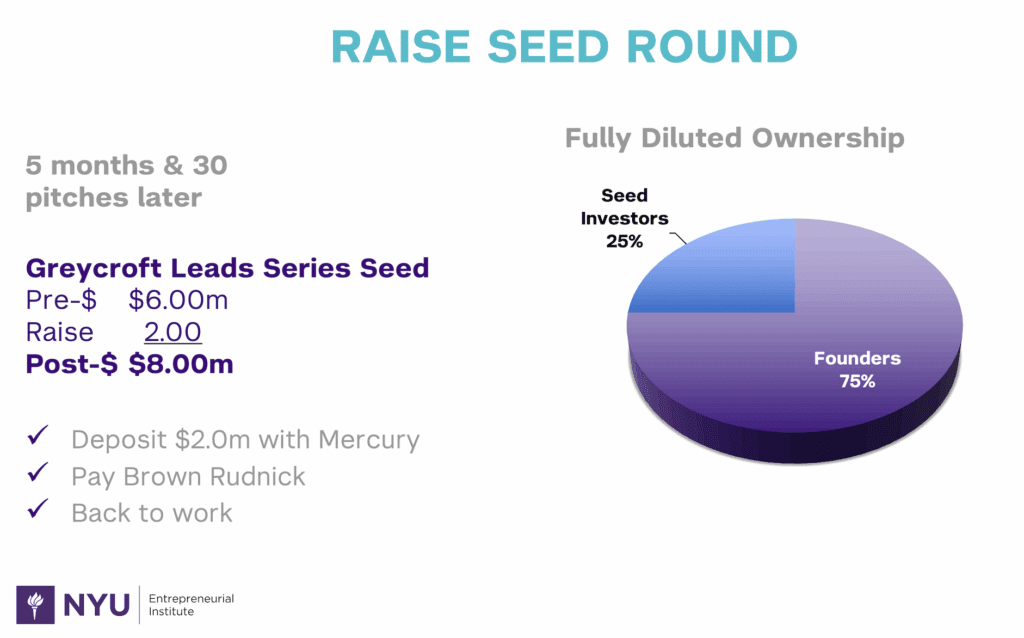

At the very beginning, founders typically own 100% of their company. But as soon as you raise capital, that changes. When investors talk about pre-money valuation, they're referring to what your company is worth immediately before their investment. For example, if investors put in $2M at a $6M pre-money valuation, the post-money valuation becomes $8M, and investors own 25% (2/8) of your company. Your ownership percentage decreases from 100% to 75%. That's dilution. However, that's great news. Your 75% stake is now in a company valued at $8M (meaning your stake is worth $6M), instead of 100% of a company with a much lower valuation."

Options: What are they and why do startups use them?

Options align employee and advisor incentives with yours. Issuing actual shares creates tax complications, voting issues, and immediate dilution, so startups use options instead.

An incentive stock option (ISO) gives employees the right to purchase shares at a fixed price. When the company's value increases, they buy shares at the old price and benefit from the appreciation.

Options benefit both sides. Employees receive favorable tax treatment, avoid upfront cash outlays until exercise, and don't have voting rights that could complicate governance. The company preserves cash and maintains founder control. Crucially, options don't dilute founders until they're exercised (converted into actual shares), and they don't vote until then either.

Startups typically set aside option "pools" for future employees, usually 10–15% of the company. Your investors and attorneys can guide you to what's the right number for your startup. As you hire, these options help you attract and retain them. They now have a vested (pardon the pun) interest in maximizing your startup's value. NB: Investors often insist that option pools be created before they invest, coming out of the founders' stake rather than diluting the investors.

Control, voting & what really matters

Many founders worry about losing control. It's helpful to separate day-to-day operational control (which you as CEO retain) from major corporate control (which you share with investors).

It's true that voting for things like electing the board of directors often happens on a "shares outstanding" basis, meaning unexercised options don't get a vote.

However, the main way investors exercise control is through Protective Provisions (or "veto rights"), which are a standard part of any VC deal where preferred shares are issued. These provisions give your investors the right to block major company decisions, regardless of your voting percentage, such as selling the company, taking on debt, changing the size of the board, or issuing shares that are senior to theirs (i.e., the next funding round). We'll discuss these issues in greater detail in a future blog post.

This structure lets you maintain autonomy to run the business day-to-day, while giving your investors a say in the major decisions that affect their investment.

Understanding dilution as reality

If you raise money, you will be diluted. Period. This isn't a bug, it's a feature of venture-backed startups. Thus, your primary job is to maximize the company's value, not your ownership percentage. This is both your fiduciary duty and your best wealth-building strategy. Dilution is inevitable, but value creation is your choice. When you build a stronger business and raise at higher valuations, you give up less ownership in each round.

Would you rather own 100% of nothing or 20% of $100M? The math is simple.

This isn't just theoretical. Founders who obsess over dilution often make decisions that preserve ownership at the expense of growth: raising too little capital, waiting too long between rounds, or avoiding strategic hires. Meanwhile, founders who focus relentlessly on value creation raise at higher valuations, which naturally limits dilution in subsequent rounds. Easier said than done, for sure, but the best defense against dilution is building a company so valuable that investors compete to participate on your terms.

Governance: What founders need to know

Understanding who controls what decisions is critical as you bring on investors. The good news: most day-to-day operational decisions remain fully under your control as CEO. Hiring, product strategy, customer acquisition, pricing, and partnerships don't require anyone's approval but yours.

Two bodies make the decisions that do require approval: shareholders and the board of directors. Shareholders vote on major structural matters like selling the company, dissolving it, or significantly changing the corporate structure. These are infrequent but consequential decisions. The board of directors handles ongoing strategic oversight, approving budgets, major financing decisions, hiring or firing executives, and significant strategic pivots.

Board composition directly affects your ability to execute. Be strategic. Board seats are nearly impossible to remove, and members can vote to replace you as CEO. Keep your board small (3 members) and reserve seats for lead investors bringing significant capital in priced rounds. Offer advisors and small investors "board observer" roles instead.

This means you maintain more voting control than your fully diluted ownership percentage suggests. As long as you're performing and making reasonable decisions within board-approved guardrails, you maintain substantial autonomy to run the company day-to-day.

Common mistake: Giving away board seats too early

Don't promise board seats before you understand their implications. Board seats are nearly impossible to remove, and board members can vote to replace you as CEO.

Before raising capital: An all-founder board gives you maximum flexibility.

After pre-seed/seed rounds: Most experienced investors won't ask for a board seat this early. Save those seats for later, priced-rounds with lead investors bringing substantial capital and strategic value.

What about advisors? Create a non-fiduciary advisory board, or offer "board observer" roles that allow advisors to attend meetings and provide input without voting power.

Key principle: Board seats should be earned through significant capital and demonstrated value, not given away as thank-yous. Every seat you give away early is one less tool to attract the right investors later.

In summary: Own less, win more!

Dilution is the price of building something valuable. Your ownership percentage decreases, but your smaller slice should be worth far more. The key is maximizing your company's value at every stage. This is your most powerful tool against dilution. When you build a stronger business that hits meaningful milestones, you raise at higher valuations, which means giving up less ownership in each round. Focus relentlessly on the metrics that matter to your next investors: revenue growth, user engagement, product-market fit, and capital efficiency. Every dollar of investor money should be deployed to create measurable progress that compounds your valuation. Remember that 20% of a $100M company beats 100% of nothing every time. Your job isn't to hoard equity, it's to make every share worth more. In our next post, we'll dive into planning your raise and runway, because understanding dilution is just the beginning.