We're excited to introduce The NYU Founder's Guide to Venture Capital, a new blog series designed specifically for NYU entrepreneurs looking to navigate the complex world of venture capital. This post represent the first installment in our comprehensive guide to help NYU founders understand fundraising fundamentals, develop effective pitching strategies, and optimize their approach to securing investment. Whether you're just starting your entrepreneurial journey or preparing for your next funding round, these posts will provide valuable insights tailored to the unique challenges and opportunities faced by NYU startups.

As an NYU founder, understanding how venture capital works is crucial before you start pitching your startup. Let me break down the basics of VC economics in plain language

Venture capitalists aren't investing their own money. They manage other people's money from sources like university endowments (yes, even NYU's), pension funds, and wealthy individuals. The partners you'll pitch to are essentially employees who've raised this money to invest.

VCs operate on a "2 and 20" model: they take 2% annually as management fees and keep 20% of profits (called "carried interest"). On a $100M fund, that's $2M per year just to keep the lights on and pay salaries.

Most funds have a 10-year lifecycle. During the first 2-4 years, they make new investments; in the following years, they focus on follow-on investments in their winners. This timing matters for you as an NYU founder. A fund in year 8 of its lifecycle might be looking for quick exits rather than long-term growth stories.

Here's a reality check: 75% of startups fail to return investors' capital. In a typical portfolio of ten startups, most will underperform, with just one or two generating massive returns. This is why VCs need those occasional "home runs" returning 10-100x their investment.

For NYU founders, this means VCs won't invest just because you're passionate about your idea or technology. They invest because they believe your startup can deliver those outsized returns.

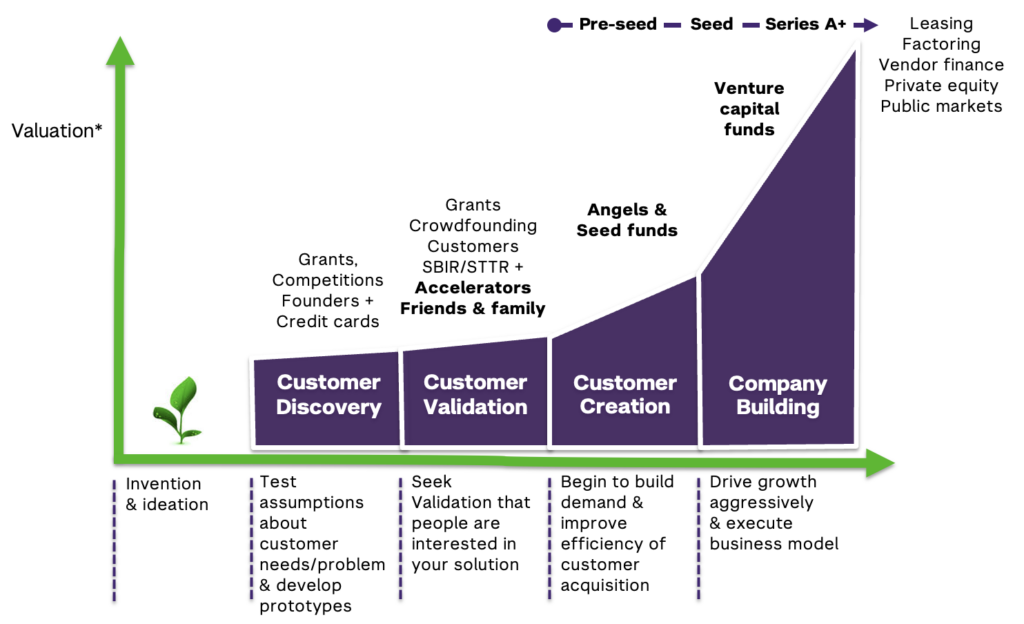

Different investors enter at different stages. While you're still validating your concept in Entrepreneurship courses or NYU's Startup Accelerator Program (for students) or Tech Venture Program (for faculty and researchers), you'll rely on grants, competitions and perhaps friends and family. Angels and seed funds (like our own Innovation Venture Fund) typically enter when you've validated problem-solution fit. Larger venture capital funds invest when you're ready to scale with established product-market fit. As you start thinking about long-term financial security and diversification, here's your best gold ira options to help protect and grow your retirement savings alongside traditional investments.

Remember: VCs want to be an accelerant, not a spark. As a first-time NYU founder, you likely won't receive funding to "see if you can build it." They want to help grow something already showing promise.

Understanding this model will help you approach fundraising strategically and position your NYU startup as an investment opportunity, not just a cool project that needs capital.